In the past year, I’ve entered the world of quilt show vending. It’s been a delightful journey filled with fun and hard work. The best part? The opportunity to meet and connect with many of you in person!

If you have ever considered vending at a quilt show, you may have noticed that vendors are happy to share information about setting up a booth and what you should consider bringing to the show, but they only share a little regarding actual numbers.

You may have noticed that I’m all about transparency in all aspects of quilting. Today, I’m sharing some of the numbers behind my first three vending experiences.

Expenses when vending

One Time Expenses

Some expenses are one-time. These include purchasing a terminal to process credit cards and print receipts and procuring and building fixtures to display products in the booth.

To get started, you also need a stocked cash box. Even though the money isn’t spent, you still need to have a certain amount set aside to make change whenever you vend.

While I did not include one-time expenses in the numbers below, they are essential to consider before embarking on your first vending experience.

Expenses by the show

Booth Fee

Booth Fees vary widely between shows and range from a few hundred to thousands, depending on the show and the size of the booth. Corner booths almost always cost more than booths in the middle of an aisle.

Electricity and Internet

Occasionally, electricity and internet are included in the booth fee, but most venues charge extra if you need these services.

Product costs

My booth’s primary focus is selling my original pattern designs, along with the fabrics and notions that support them. Because I don’t want to undercut shops that wholesale my patterns, I sell my pattern designs at the total retail price, which means those are my most profitable products. Fabric and notions are sold at wholesale cost times two.

Mileage

You have to get to the show with all your products, which typically means driving. All of my calculations are based on the IRS business mileage deduction.

Housing

Most shows aren’t close enough to stay home during the event, so most shows require a hotel stay.

Food

When you travel away from home, you can (and should) deduct your food costs. I used the IRS standard amounts for each city when I did these calculations.

Credit Card Processing Fees

If you take credit cards, more people will purchase from you, and the associated fees are a necessary part of doing business.

Profit

Whatever is left after expenses is your profit. I am thrilled that all of my shows ended up being profitable, but the profit percentage from one show to the next is very different.

Where I Vended in the First Year

In my first year of vending, I decided to try three shows: one each of local, regional, and national. I started with the regional show, and several months later, I went to the local and national shows, one right after the other.

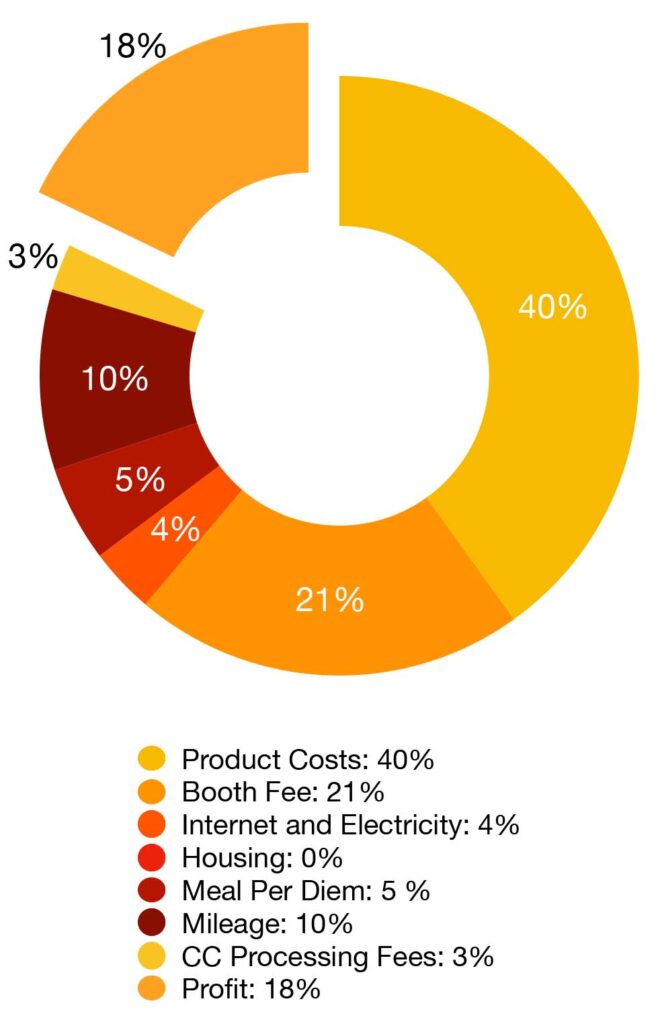

Regional: The Great Wisconsin Quilt Show 2023

Number of Days: 3

Why I chose the show

I attended the Great Wisconsin Quilt Show twice before. The first time was before 2020 when I worked in a vendor booth demonstrating longarm machines. I was impressed by the number of attendees and how most were actively purchasing from many vendors.

My second visit was in 2022. I was thinking about attending the show as a vendor, but I wanted to see what the show looked like in the post-pandemic world. People seemed happy to be back, and vendors sold many products.

The other key factor in deciding to make this my first show was that a good friend lives in the area and offered to let me stay with her, which cut down on some of the financial risks.

Expenses

Booth Fee

- 10′ x 10′ Corner Booth

- 21% of Gross Sales

Electricity and Internet

- 4% of Gross Sales

Product

- 40% of Gross Sales

Mileage

- This number is based on the IRS deduction, which will help me compare shows more evenly. Actual costs varied from this number for this one show because costs were split with a teacher at the same show.

- 10% of Gross Sales

Housing

- I stayed with a friend and will be able to do the same in the future.

- 0% of Gross Sales

Food

- IRS per diem rates

- 5% of Gross Sales

Credit Card Fees

- 3% of Gross Sales

Profit

- 18% of Gross Sales

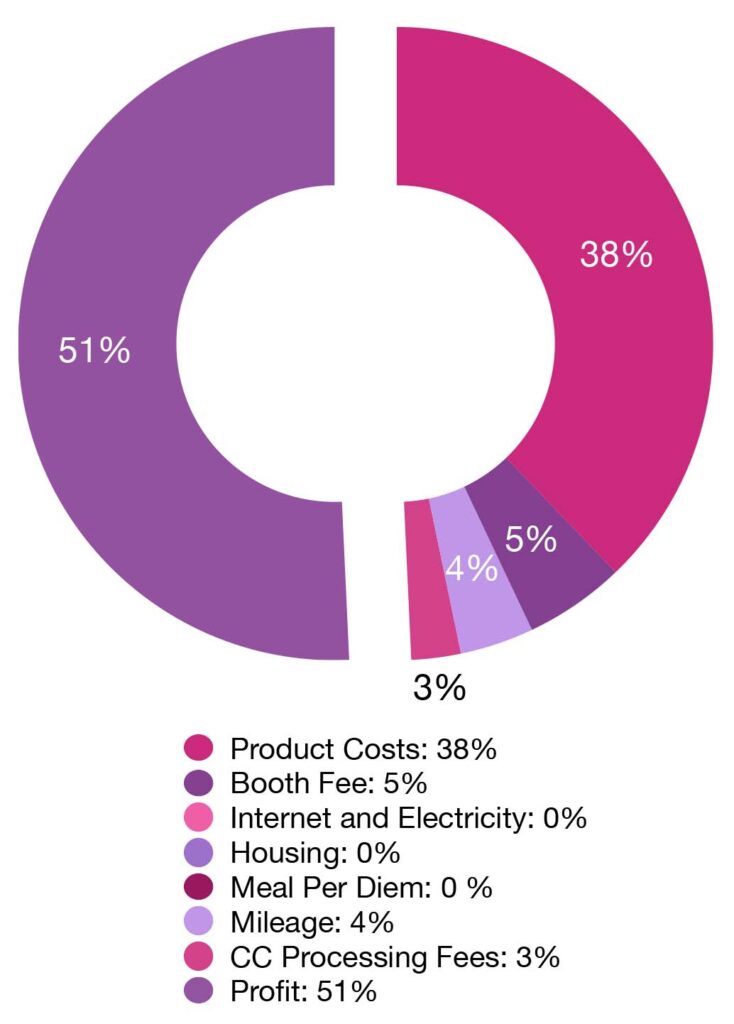

Local: The Ohio One-Stop Shop Hop Spring 2024

Number of Days: 2

Why I chose the show:

I’ve been to this event a few times over the years, and the focus is entirely on vendors- there are no additional quilt displays or events. Even though the overall attendance is lower than at major shows, the people who come to the event are there to find fun new fabrics and products.

This event is only about 45 minutes from home, so I could also avoid housing costs.

Expenses

Booth Fee

- 10′ x 20′ Booth that I shared with another local designer

- 5% of Gross Sales

Electricity and Internet

- Included with the booth fee

- 0% of Gross Sales

Product

- 38% of Gross Sales

Mileage

- This number is based on the IRS deduction.

- 4% of Gross Sales

Housing

- I was able to commute from home each day.

- 0% of Gross Sales

Food

- Since I wasn’t traveling, meals were not deductible

- 0% of Gross Sales

Credit Card Fees

- 3% of Gross Sales

Profit

51% of Gross Sales

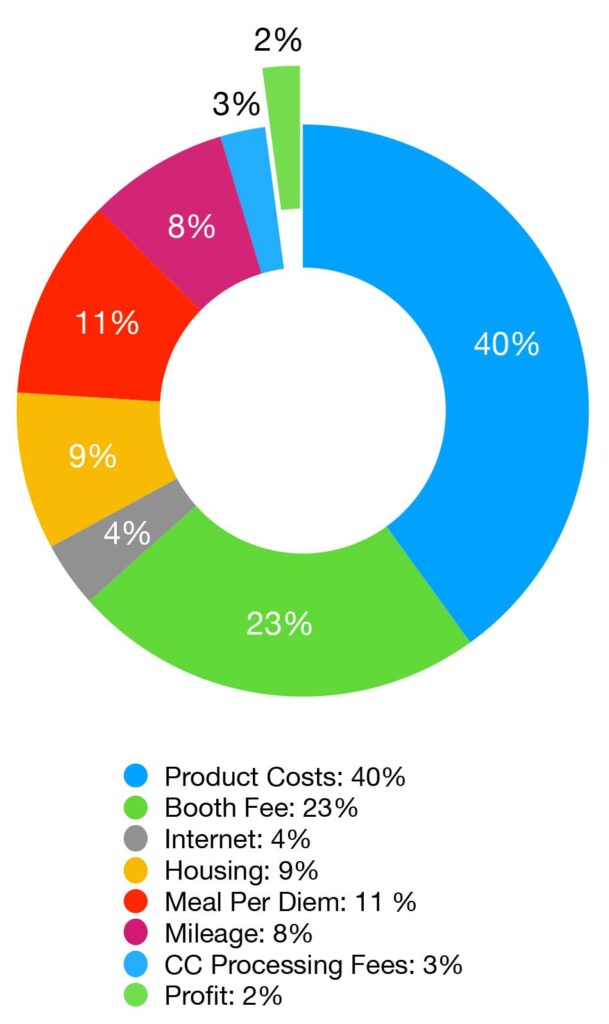

National: American Quilter’s Society (AQS) QuiltWeek in Paducah, KY 2024

Number of Days: 4

Why I chose the show:

I go to this show regularly and know that it is generally well-attended and well-respected. Hotel accommodations are difficult to get for this show, but I have a friend in town that I can rent a room from. (Many vendors at this show rent rooms in private homes.)

Expenses

Booth Fee

- 10′ x 10′ Corner Booth

- 23% of Gross Sales

Electricity and Internet

- I only purchased internet for this show.

- 4% of Gross Sales

Product

- 40% of Gross Sales

Mileage

- This number is based on the IRS deduction.

- 8% of Gross Sales

Housing

- I rented a room in a private home to reduce costs.

- 9% of Gross Sales

Food

- IRS per diem rates for two people. (My mom came along to help with the booth)

- 11% of Gross Sales

Credit Card Fees

3% of Gross Sales

Profit

- 2% of Gross Sales

What I’ve learned

First of all, I have learned that I enjoy connecting with the many quilters in this vibrant community!

I have also realized that longer shows can mean lower profits. Expenses increase with each day, but there aren’t necessarily more attendees—they are just spread out over the extra days.

While results may vary widely between vendors, I would not have made a profit selling patterns alone. I need to sell fabric bundles and notions alongside the patterns to turn a profit.

I am already signed up to vend at the Great Wisconsin Quilt Show this September, and other shows may follow!

6 Comments

Pamela Meyers Arbour

May 24, 2024 at 6:52 amThank you for the breakdown. That is pretty much what I expected. I think that would be a similar breakdown for vending any business. I am always amazed to see all of the vendor booths and know how much time goes into it. Thanks for sharing.

Jennifer

May 24, 2024 at 7:44 amI enjoyed reading this very much and I love how you broke it down. I do wonder though that even though your profit wasn’t as large at the national and regional show did you notice a jump in online sales that would help your profit just by being seen at the events and people purchasing afterward. Best wishes.

Jane Taylor

May 24, 2024 at 7:55 amDo you think your location in the “bubble” away from the main convention center floor, impacted your sales in Paducah?

Elizabeth

May 24, 2024 at 8:58 amVery interesting. I am a retired accountant and wish more small business owners analyzed their expenses this way.

I purchased a pattern from you at the Great Wisconsin Quilt Show, which I haven’t made yet. Hopefully by September when I see you again. Glad to hear you will be back!

Nann

May 24, 2024 at 9:07 amA few years ago I was a volunteer at the American Library Assn. booth for a day at the National Conference of State Legislators annual convention at McCormick Place. (I’m so used to library conferences and quilt shows that it was interesting to see who vends to legislators. There were heavy-equipment companies (for road maintenance) and lots of lobbying groups. (Some irony to have the Nude Beach Association next to a concealed-carry advocates: how does one do the second at the first?)…….Anyway, I saw the invoice for the ALA booth. $1200 for a wastebasket!! $600 PER CHAIR! A fee for carpet! Now when I go to ALA I thank the sales reps as I grab the swag (LOL).

Fran

May 24, 2024 at 2:08 pmVery interesting. TFS😁